Governmental Barriers to Small Business Financing for People with a Criminal History

Collateral Consequences Resource Center

Closed Captioning is available by tapping the CC icon above

According to the Collateral Consequences Resource Center (CCRC), individuals seeking to start new businesses face a number of challenges. For individuals with a criminal history, these challenges of establishing and growing a new business increase dramatically. The Center points to a "particularly stifling series of federal regulations and policies" that impose broad criminal history restrictions on access to government-sponsored business loans.

Given that about one third of adult Americans have an arrest or conviction record, of whom a disproportionate percentage are people of color, the Center asserts that it is important to reconcile this population’s limited access to government-sponsored business capital with the emerging public policy of encouraging reintegration and second chances.

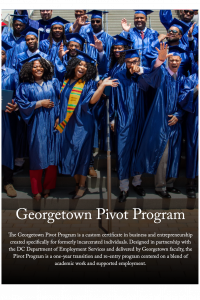

At this Georgetown on the Hill event, a panel of experts moderated by Crystal Francis, Program Manager, Georgetown University Pivot Program, discuss the economic and social impact of these restrictive policies in a forum with Q&A. Panelists consider the issues that arose when the policies were applied to pandemic relief funds; the possible correlation between criminal history and creditworthiness; and the elements of a “fair chance” approach to business lending.

Panelists include:

- Taja-Nia Henderson, Professor of Law, Rutgers University Law School

- Sekwan Merritt, Entrepreneur and Owner, Lightning Electric, a Baltimore-Based Electrical Contractor

- Chris Pilkerton, Chief Legal and Regulatory Strategy Officer for the Accion Opportunity Fund, and former Cabinet member and head of the U.S. Small Business Administration

- David Schlussel, Deputy Director, Collateral Consequences Resource Center